The digital age has brought many changes to our lives, but none more so than the way we communicate and the way we handle money. Taking all of this into consideration, the online sportsbooks that are prevalent today can hardly be called anything other than a digital treasure chest. Ghanaian gamblers can find this to be true as they are able to access the top by betting on sports online with such necessary ease.

An online bookmaker will accept your preferred method of payment. Your chosen banking option is likely to come with some outstanding sports betting welcome bonuses. To find out which deposit methods the top online sportsbooks in Ghana accept, check out our guide to banking options. Then you can make an informed choice about where to open your betting account.

Bank deposits remain one of the most reliable payment methods for Ghanaian punters, offering a secure way to fund accounts without relying on third-party wallets. As someone who has tested and compared multiple platforms across the region, I've created this 2026 guide to highlight the safest casinos and sportsbooks that accept direct bank deposits. Each option listed here has been vetted for transaction speed, security standards, and regulatory compliance - so you can deposit with confidence and focus on your betting experience.

Licensed Platforms for Ghana 2026

|

Operator

|

Bonus

|

Features

|

Claim Now

|

|---|---|---|---|

|

300% Match

|

|

|

|

|

100% Match

|

|

|

|

|

50% Match

|

|

|

|

|

200% Match

|

|

|

|

|

100% Match

|

|

|

|

|

400% Acca Win Boost

|

|

|

|

|

200% Slot Bonus

|

|

|

|

|

100% Match

|

|

|

|

|

Daily Jackpot

|

|

|

|

|

100% Match

|

|

|

Why Choosing the Right Deposit Method Matters

Choosing the right bank deposit method in Ghana is an important financial decision that affects your future. Your choice will protect your money, make transactions easier, and work for you regardless of your technical skills. Here's what you need to know about making deposits at Ghanaian banks.

Security and fraud prevention

Security is at the forefront of digital banking today. The Bank of Ghana requires service providers to take strong measures to protect systems from cyber-attacks, money laundering, and terrorist financing. These safeguards keep your hard-earned money safe.

Banks use multiple layers of security such as end-to-end encryption, multi-factor authentication, and account name validation. In addition, the Ghana Instant Pay (GIP) platform uses advanced security protocols that work well. A 2024 GhIPSS report shows zero successful attacks despite a 17% increase in fraud attempts on legacy systems.

Traditional collection methods such as "susu" (informal savings schemes) often fall prey to fraud, causing people to lose trust in the operators. Regulated banking channels are a safer bet because they have full oversight and technical safeguards.

Speed of transaction

Speed of money movement is important, especially for businesses and urgent payments. Ghana's modern banking system has made transactions much faster. Rural banks now process transactions in less than 5 minutes - sometimes as little as 2 minutes - compared to the previous average of 15 minutes after upgrading their systems.

GIP handles transactions up to GHC 50,000 per transfer. This makes it ideal for personal transfers and corporate payroll. Companies managing supply chains and payroll prefer GIP because it helps in areas where traditional banking isn't widely available.

Real-time monitoring has improved transaction tracking and reporting accuracy. Banks now have more confidence in their operations.

Ease of use for all users

Access to banking varies across Ghana. Traditional banking works best for people with regular incomes in the formal sector. Informal workers, who make up the majority of Ghana's workforce, are often left out.

Mobile money helps the unbanked access financial services through mobile networks. Services like "Kudi Nkosuo" bring banking to people's doorsteps through collection services designed for the informal sector.

Digital payments must reach more people. About 90% of Ghanaian businesses are micro, small and medium enterprises (MSMEs), and they should accept digital payments. The Bank of Ghana launched a three-tiered merchant account system and promoted the GhQR code as a cheaper option than point-of-sale devices.

Support for Ghanaian cedis

Supporting the local currency through deposit methods contributes to financial stability. Fixed deposits in Ghana are only available in Ghanaian cedis. Bank channels also pay remittances in cedis.

The Bankers Association of Ghana wants citizens to protect the value of the cedi by using it more in everyday transactions. Banking services that work well with the local currency help keep the economy stable and support local financial systems.

Your choice of bank deposit methods that handle cedis properly helps to reduce the gap between interbank and parallel market rates. This strengthens the economy as a whole.

Best Bank Deposit Sites in Ghana

I've taken a closer look at Ghana's digital world and found several outstanding platforms that offer secure, fast bank deposit options. These sites combine ease of use with reliable security features to keep your money safe and available.

MelBet

MelBet Ghana has been operating with a legal gaming license from the Gaming Commission of Ghana since June 2020. I use this platform often and love that it accepts Ghanaian cedis, making transactions easy for local users.

The platform's deposit system focuses on mobile money options - MTN, Vodafone and Airtel Tigo. In my experience, this limited selection actually makes things easier. While some sources say they don't accept card deposits or e-wallets, others mention that they support Visa and Mastercard payments with 3D authentication.

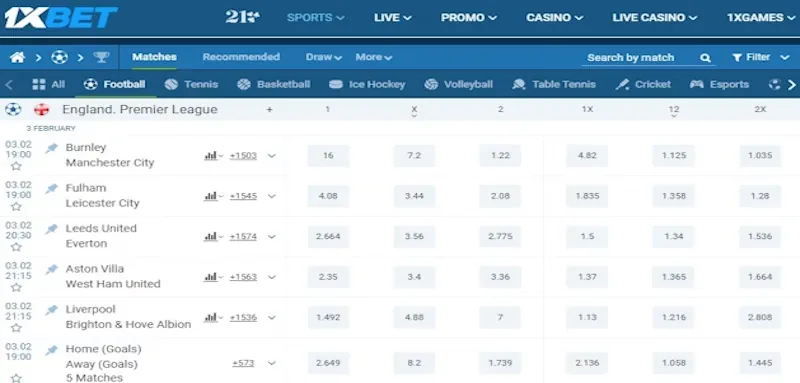

1xBet

1xBet shines with 62 deposit options for Ghanaian customers. The platform has six recommended options for Ghana: MTN, Vodafone, MoneyGO, AirtelTigo Money, Mybux and MoneyGO Vouchers.

The platform's Visa and Mastercard options work great, with deposits starting at GH₵ 9.64 and no upper limit. Deposits are made instantly with no fees. You can also use e-wallets such as Skrill, Neteller and EcoPayz, with minimum deposits ranging from GH₵ 12.69 to GH₵ 37.43.

1xBet's support for 37 different cryptocurrencies, including Bitcoin, Ethereum, and Dogecoin, gives tech-savvy bettors an unmatched range of options.

Betway

Betway has the easiest deposit system I've used. You can deposit using MTN Money, Vodafone Cash, Airtel Tigo Money and bank cards (Visa/Mastercard).

The platform's minimum deposit requirements are incredibly low - GH₵1 for mobile money and GH₵2 for cards. You can deposit up to GH₵100,000.

Money will appear in your Betway account instantly, although network issues can cause delays of up to 48 hours. MTN Money deposits are limited to GH₵5,000 per transaction to encourage responsible gambling.

Paripesa

Paripesa stands out for its variety of fee-free deposit options. You can use mobile money services (MTN, Vodafone starting at 10 GHS with limits up to 50,000 GHS), international e-wallets (Skrill, Neteller), bank cards (Visa/Mastercard with 10 USD minimum), and many cryptocurrencies.

The platform works well for both casual and serious bettors. Every deposit method is instant and free.

22Bet

22Bet offers a full range of deposit options for Ghanaian users. These include credit/debit cards (Visa/Mastercard), e-wallets (Skrill, Neteller, Perfect Money), mobile money (MTN, Vodafone, Airtel) and cryptocurrencies.

The platform features mobile money integration that covers Ghana's major telecom networks. My tests show that these methods give you instant deposits with no additional fees. Crypto users can choose from over 29 different options, making it a great choice for digital currency enthusiasts.

Top Bank Deposit Methods in Ghana

Ghana's banking system offers many ways to deposit money. Each option has its own advantages that suit different financial needs. Let me share what I've learned from using these systems.

Mobile Money (MTN, Vodafone, Airtel Tigo)

Mobile money is now leading Ghana's financial world. My extensive use of these services shows that they are helping more people access financial services, especially in rural areas. MTN Mobile Money (MoMo), Vodafone Cash and AirtelTigo Money are the main platforms that deliver funds in minutes.

The best thing about mobile money is that anyone can use it with just a phone, even without a bank account. I've seen how these services facilitate quick transfers between people. They work well for paying bills and everyday purchases in both cities and villages.

Bank Cards (Visa, Mastercard)

Bank cards still play a key role in formal money matters. The GCB and other banks work with three card networks: Gh-link (for use in Ghana only, approved by the BoG), Visa, and Mastercard.

The security features of these cards are solid. Each card has a microchip that keeps data secure and prevents copying. You also get extra protection with 3D Secure/Verified by Visa, which uses SMS or email to verify online purchases.

Bank Transfers

Bank transfers give you greater security and control when you need to move large sums of money or run a business. GCB and other major banks allow you to send money locally and internationally with the latest features.

You can move money instantly between any two branches. This helps small businesses, merchants, and families supporting students. Most transfers through these 15-year-old services take as little as 15 minutes.

E-wallets (Neteller, Skrill)

E-wallets bridge the gap between old-school banking and mobile money. GhanaPay shows how far we've come - it's a mobile money service from banks, rural banks and savings institutions.

I love using e-wallets because they do so much. You can send money, pay bills, buy things, and check your balance on your phone. They keep your money safe with PINs and fingerprint scans.

Cryptocurrency (Bitcoin, USDT)

Crypto has taken off in Ghana despite some regulations that hold it back. Young Ghanaians are buying and selling Bitcoin, USDT, and Ethereum on Binance and KuCoin. Ghana now ranks among the top countries in Africa for crypto usage per capita.

People often use crypto to protect against changes in the value of the cedi, especially with stablecoins. The Bank of Ghana is now working on rules for crypto, showing a shift from resistance to engagement.

USSD and Internet Banking

USSD banking allows you to use your account without the Internet - just dial codes like *966#. You can check balances, link accounts to mobile money, send money, and pay bills.

Internet banking gives you anytime, anywhere access to your accounts. It helps me manage accounts, set up transfers for later, pay bills, and handle service requests myself.

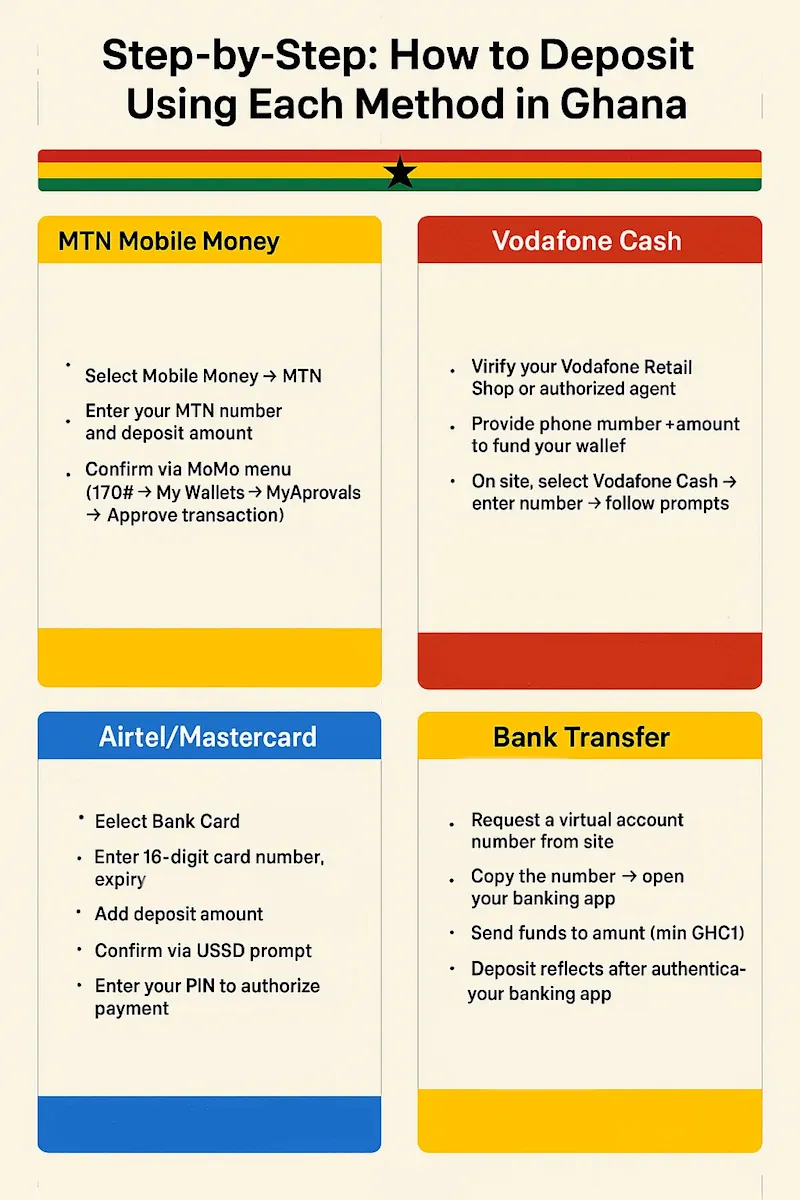

Step-by-Step: How to Deposit Using Each Method

Making deposits at bank deposit sites in Ghana may seem complex at first, but each method becomes straightforward once you understand the steps. I've used all of these methods personally and have created this handy guide to help you get through them with ease.

MTN Mobile Money

MTN MoMo deposits work this way:

- Log into your banking or betting account and select "Deposit" or "Add Money"

- Choose "Mobile Money" then "MTN" from the payment options

- Enter your MTN number and desired deposit amount

- You'll receive a push notification or can dial *170# to access your MoMo menu

- Select "My Wallets" (Option 10), then "MyApprovals"

- Enter your PIN to view pending approvals

- Confirm the transaction matching your deposit amount

Vodafone Cash

Your Vodafone Cash deposits need these steps:

- First ensure your Vodafone Cash account is active

- Visit any Vodafone Retail Shop or authorized agent

- Provide your phone number and deposit amount to the agent

- You'll receive an SMS confirming your wallet has been credited

- On the deposit site, select "Vodafone Cash" as your payment method

- Enter your registered number and follow the prompts to complete the transaction

Airtel Tigo Money

AirtelTigo Money works this way:

- Verify your AT Money account is active by dialing *110#

- The deposit platform lets you access the deposit section

- Select AirtelTigo Money from available payment methods

- Enter the deposit amount (minimum GH₵ 1)

- You'll receive a USSD prompt on your registered phone

- Enter your AirtelTigo Money PIN to authorize the payment

Visa/Mastercard

Card deposits follow these steps:

- Select "Bank Card" or "Visa/Mastercard" in the deposit section

- Enter your complete 16-digit card number, expiry date, and CVV

- Specify your deposit amount

- Click "Pay" or "Top Up Now" to initiate the transaction

- Complete any additional verification (PIN, OTP) requested by your bank

Bank Transfer

The bank transfer process works like this:

- Request a virtual bank account number from your deposit site

- Copy this account number

- Log into your personal bank app or visit your bank

- Initiate a transfer to the virtual account number

- The transferred amount will be credited to your account

E-wallets

E-wallet deposits need these steps:

- Open your app and select "Add Money" or "Deposit"

- Choose your preferred e-wallet (Skrill, Neteller)

- Log into your e-wallet account when prompted

- Specify the amount to transfer

- Confirm the transaction using your e-wallet authentication method

Comparison Table of Payment Methods

Understanding deposit methods at Ghanaian banks can help you make better financial decisions. Let me share what I have learned from working with different payment systems.

Speed of deposit

Mobile money stands out as the fastest option, with transfers completed in minutes. Bank transfers take varying amounts of time to process. You'll see Mobile Money deposits clear within 1 business day, while card payments take 2-3 days. International card transactions can take up to 5 business days. Domestic e-wallet transactions are processed instantly.

Fees involved

Each payment processor has its own fee structure:

- Mobile Money: Fees range from 1.9% (iPay) to 3.5% (DPO) per transaction

- Local Cards: Rates start at 1.95% (Paystack) and go up to 4.5% (DPO)

- International Cards: You'll pay higher fees of 3.5-4.5%

- Setup charges: One-time fees apply with expressPay (GH₵500), Interpay (GH₵1,000), and DPO (GH₵2,400)

Minimum deposit amount

Each account type needs different minimum amounts:

- Savings accounts: Access Bank and CAL Bank start at GH₵10, while Standard Chartered requires GH₵100

- Current accounts: Personal accounts need GH₵50-500, business accounts require GH₵100-4000

- Fixed deposits: You'll need at least GH₵500

- Call accounts: These start at GH₵100,000

Accepted currencies

Ghana Cedis remains the primary currency for most payment processors. Zenith Bank and Bank of Africa allow you to open accounts in USD, EUR and GBP. Businesses that need foreign exchange options can use DPO Pay and Flutterwave's multi-currency support.

Best use cases

My experience shows:

- Mobile Money works great for daily transactions and banking in rural areas

- Bank transfers shine with larger amounts and business operations

- Cards give extra security for online shopping

- E-wallets make digital payments simple

- Foreign currency accounts help people who often receive money from abroad

Final Verdict

Navigating Ghana's payments landscape means knowing what each method can and can't do. This article draws on my hands-on experience with bank deposits, which can be found in every corner of the country. Mobile money is the lifeblood of Ghana's financial development, opening up banking to millions of people who couldn't use traditional banks.

Your deposit method of choice needs to be fast. Mobile money completes transactions in minutes, but bank transfers can take days, depending on your bank. The fastest way to get your money depends on what you need it for.

The best bank deposit sites depend on what works for you. Ghana now has options for everyone's financial needs - from fast mobile money transfers to secure bank cards and flexible e-wallets. Match these features with what you need, and you'll find the right mix of convenience, security, and cost for your banking needs.