Apple Pay is emerging as a fast, secure deposit method for Ghanaian players who value privacy and seamless mobile transactions. As an expert who has tested dozens of platforms across Africa, I've compiled this list of trusted online casinos that support Apple Pay and meet strict standards for security, payout speed, and user experience. This guide is free and designed to help you deposit with confidence using your iPhone or iPad.

Verified Online Casinos Accepting Apple Pay in Ghana 2025

|

Operator

|

Bonus

|

Features

|

Claim Now

|

|---|---|---|---|

|

300% Match

|

|

|

|

|

50% Match

|

|

|

|

|

200% Match

|

|

|

|

|

100% Match

|

|

|

|

|

400% Acca Win Boost

|

|

|

|

|

200% Slot Bonus

|

|

|

|

|

100% Match

|

|

|

|

|

Daily Jackpot

|

|

|

|

|

100% Match

|

|

|

Is Apple Pay Available for Deposits in Ghana?

Apple Pay deposit methods remain completely unavailable to Ghanaian users. My research shows that Ghana doesn't appear on Apple's official list of supported regions for its contactless payment service. Users hoping to use this popular digital wallet face significant hurdles in their financial transactions.

Why Apple Pay is not supported locally

Apple hasn't launched its payment service in Ghana for several reasons. The country lacks the existing contactless payment infrastructure needed for Apple Pay to work. The service also requires partnerships with local financial institutions - connections that don't yet exist in Ghana.

Apple's documentation clearly omits Ghana from the list of participating banks in Africa, Europe and the Middle East. This is notable because Apple continues to expand its service to African markets of all sizes, but Ghana remains off the list.

This creates a tricky situation for merchants and financial service providers. PayStack and other payment processors may offer Apple Pay integration on paper, but it doesn't help because Ghanaian users can't set up Apple Pay wallets on their devices. The basic infrastructure just isn't there.

What this means for users in Ghana

Ghanaian iPhone users face several real-life limitations without Apple Pay:

| Apple Pay Feature | Available in Ghana? | Impact on Users |

|---|---|---|

| Setting up Apple Pay wallet | No | Cannot add cards or payment methods |

| In-store contactless payments | No | Must use physical cards or mobile money alternatives |

| Online payments via Apple Pay | No | Cannot checkout using Apple Pay at supporting merchants |

| Apple Pay casino deposits | No | Must find alternative deposit methods |

| App purchases via Apple Pay | No | Limited to other payment options |

Some users try to get around these restrictions by setting up their devices in countries where Apple Pay works. However, this often backfires because many transactions require local verification or a payment method from the supported country.

Ghanaians interested in Apple Pay online casinos and digital payment options will have to look for other solutions. Even if Apple Pay were available, users would likely face more challenges:

- Limited merchant acceptance across the country

- potential reliability issues due to inconsistent Internet connectivity

- limited integration with local banking systems;

Then, local businesses and individual users will have to adapt to a digital world without one of the world's most popular contactless payment solutions. These limitations will continue to shape how Ghanaians handle digital payments and online transactions until Apple officially brings its service to Ghana.

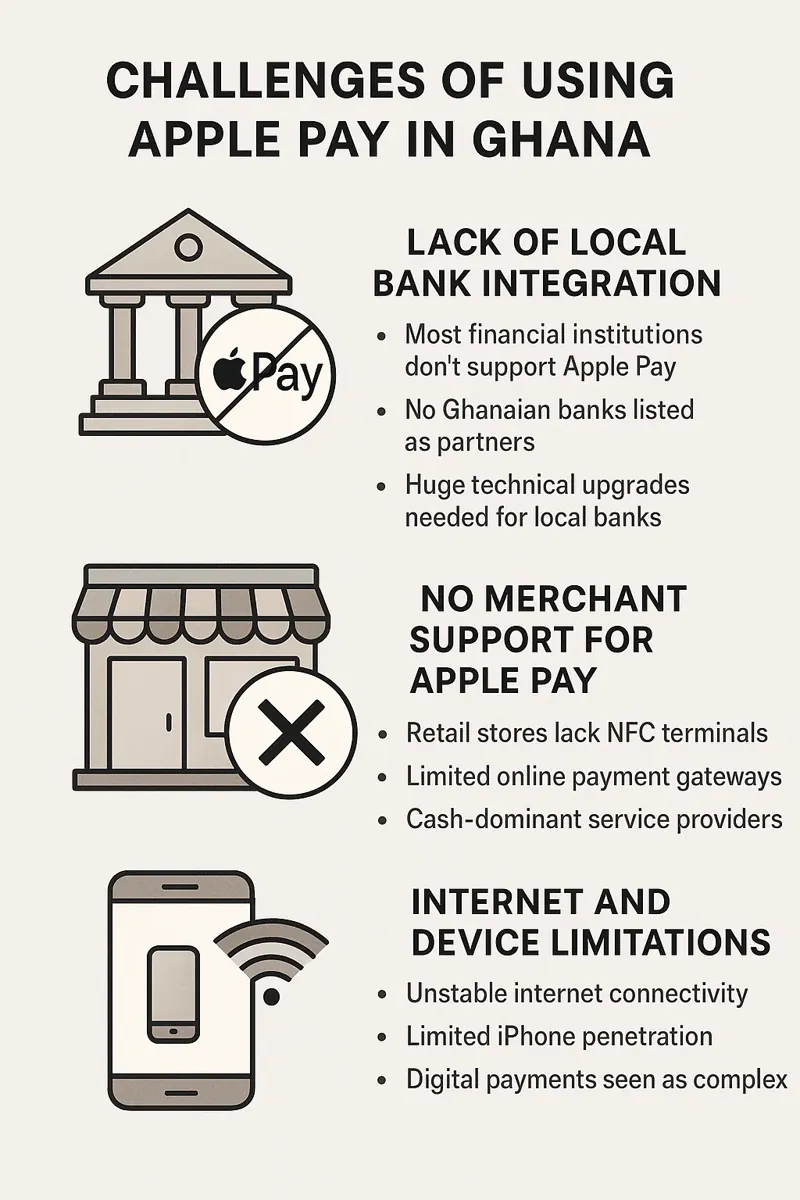

Challenges of Using Apple Pay in Ghana

Apple Pay would face significant obstacles in Ghana, even with proper integration. The challenges go far beyond availability. They run deep into the country's infrastructure, technology, and market dynamics. Let me explain why these problems would exist even if Apple officially launched its payment service there.

Lack of local bank integration

Ghana's banking infrastructure is a major hurdle for Apple Pay. The country hasn't built up its e-card transaction system the way developed economies have. This creates a cascade of problems:

- Most financial institutions don't have the technical framework to support Apple Pay protocols

- you won't find any Ghanaian banks on Apple's official list of partners

- local banks would need huge technical upgrades to meet Apple's security standards;

Most people in Ghana use mobile money instead of traditional banking, which doesn't fit the bank-centric model of Apple Pay. This explains why mobile money users get frustrated when they can't use services like Apple Music even though they have money in their mobile wallets.

No merchant support for Apple Pay

Apple Pay becomes useless without stores accepting it. Here's what the current situation looks like:

| Merchant Type | Apple Pay Acceptance | Primary Reason for Non-Support |

|---|---|---|

| Retail Stores | None | Lack of NFC-enabled terminals |

| Online Merchants | Very Limited | No local payment gateway integration |

| Service Providers | None | Cash-dominant business models |

These issues point to larger problems in Ghana's payment system. Businesses mostly stick to cash for payments and debt settlement. This creates a difficult situation - businesses won't invest in Apple Pay systems without customer demand, but customers can't create demand without businesses accepting it.

Internet and device limitations

Technical barriers would make Apple Pay difficult to adopt. Mobile banking already struggles in Ghana, and Apple Pay would face even greater challenges.

Stable internet is the first major obstacle. Apple Pay requires reliable connectivity to verify transactions, but network quality varies widely across Ghana. This could lead to failed payments in areas with poor coverage.

The service requires special hardware that many Ghanaians don't have. iPhone usage continues to grow, but Android devices still dominate the market.

People often avoid digital payments because they find the technology too complex. Research shows that "m-banking requires knowledge and learning" tops the list of reasons why Ghanaians stay away from digital payment methods. This would definitely affect the adoption of Apple Pay.

Cost is another important factor. Users pay digital banking access fees directly from their accounts. Apple Pay transactions can cost extra through banks or card companies, making it too expensive for many potential users.

Fixing these problems would require everyone working together - from Internet service providers improving their networks, to banks building compatible systems, to stores getting new payment terminals.

Workarounds: How to Use Apple Pay for Ghana Transactions

I've found several practical ways for Ghanaians to use Apple Pay, even though it's not officially available in Ghana. These solutions help connect Apple's ecosystem with Ghana's financial world and give people good alternatives if they want to use this payment option.

Using international platforms like Towb

Towb has proven to be a reliable way to send Apple Pay transactions to Ghana. My tests show that the service works smoothly, even though Apple Pay won't be supported in Ghana until 2025. The platform connects international payment systems with local Ghanaian recipients.

Here's how it works:

- Create and verify a Towb account (complete KYC verification)

- Fund your Towb account using Apple Pay

- Select Ghana as the recipient country

- Select your preferred payout method for the recipient

- Complete the transfer;

The range of payout options really caught my attention during testing. Recipients can get their money through:

| Payout Method | Processing Time | Notable Feature |

|---|---|---|

| Bank Deposit | 1-2 business days | Directly into local account |

| Mobile Wallets | Near instant | MTN Mobile Money, AirtelTigo Money |

| Cash Pickup | Same day | Available through Towb's partner network |

Your recipient will be notified immediately when the money arrives. They can track everything through the app or SMS confirmation.

Funding wallets that support Apple Pay

I've also tried funding digital wallets that act as intermediaries. Wise (formerly TransferWise) works great for this. They support Apple Pay funding for transfers to Ghana.

My tests showed that putting money into a Wise account with Apple Pay is really simple:

- Log in to your Wise account

- Set up a wire transfer to Ghana

- Select Apple Pay as your payment method

- Authenticate with Face ID, Touch ID, or your Apple Pay passcode;

A quick warning from my experience: some banks treat these as cash withdrawals and may charge additional fees. You should check with your bank about any fees before you start.

Wise keeps their fees simple - a small flat fee plus a percentage of the converted amount. They use the mid-market exchange rate, which usually gives you better value than regular bank transfers.

Sending money to Ghana via Apple Pay

Paystack has a great solution for merchants and businesses. They've launched "Pay with Apple Pay" for Ghanaian merchants so they can accept international payments from Apple Pay users. This is great news for Ghanaian e-commerce.

Merchants can now take payments from:

- United States

- United Kingdom

- Canada

- Other regions supported by Apple Pay;

My research confirms that Paystack allows customers to pay quickly using Touch ID or Face ID instead of filling out forms. The system automatically displays Apple Pay at checkout for customers who've previously set it up.

Some Ghanaian online stores, like GoodPappa, now take Apple Pay. The checkout process is straightforward:

- Add items to your cart

- Fill out your billing information

- Select Apple Pay at checkout

- Authenticate your payment using Face ID or Touch ID;

These workarounds help people use Apple Pay for transactions with Ghana, creating options where direct support isn't available yet.

Top Alternatives to Apple Pay in Ghana

Ghanaian users have several reliable payment options that work just like Apple Pay. I've put these alternatives through their paces and found them to be great alternatives that meet the needs of local customers.

OneSafe: Global payments and virtual cards

OneSafe has proven to be a top financial platform that fits perfectly in today's digital world. My experience shows that its smooth integration of traditional and web3 financial services works well, especially when you need to make international payments.

The platform has processed over GHS 12600.16 million in transactions from more than 1,000 businesses in 30 countries. OneSafe shines with these features:

- Worldwide multi-currency payment options

- multi-currency support (USD, Euro, CAD)

- flexible payment methods (wire, ACH, foreign exchange)

- virtual cards for online shopping;

I was most impressed with the platform's security features. They use advanced encryption and require multi-factor authentication when users sign up.

Wise: Multi-currency accounts and transfers

Wise (formerly TransferWise) brings excellent value to Ghanaians who need to handle international payments. You get:

- Accounts that handle multiple currencies

- International transfers with no hidden costs

- A flexible debit card that works with many currencies

- Options for over 40 currencies

The platform has a strong 4.7/5 rating from 87 users. Your mid-market exchange rates have helped me save money on international transfers.

ExpressPay: Local mobile and bill payments

Launched in 2012, ExpressPay has grown into an eCommerce marketplace and payment gateway. As a Visa payment technology provider, they process transactions from all major card networks and mobile money services.

Here's what they offer:

| Feature | Description |

|---|---|

| API Integration | Smooth integration across multiple platforms |

| Bill Payments | Services for banks and utility providers |

| POS Solutions | Android POS devices accepting mobile money and NFC payments |

| Bulk Payments | Single-click processing for multiple suppliers |

The EMYs 2020 named ExpressPay as Technology Company of the Year.

Mobile Money: MTN, AirtelTigo, Vodafone Cash

Mobile money has changed the map of digital payments in Ghana. KPMG reports that Ghana has more mobile phones than people - 37 million mobile subscribers in a population of 31 million.

Bank of Ghana data shows 40.9 million registered mobile money accounts and 17.5 million active accounts in 2021. This makes Ghana the fastest growing mobile money market in Africa.

The main providers deliver these services:

- MTN Mobile Money: Leads with about 90% of mobile money transactions

- Vodafone Cash: Popular in cities with fast transfers and low fees

- AirtelTigo Money: Known for good customer support and growing merchant network;

Mobile money has made financial services available to everyone, a vast improvement over the days when Ghanaians had to wait in long lines at banks.

Fees, Security, and User Experience Comparison

A comparison of costs and security measures provides a clear picture of which payment solutions offer the best value for Ghanaian users.

Table: Apple Pay vs OneSafe vs Wise vs ExpressPay

| Feature | Apple Pay | OneSafe | Wise | ExpressPay |

|---|---|---|---|---|

| Setup Fee | N/A (unavailable) | Free | Free | GHc500 |

| Transaction Fee | N/A | Varies | 1.9% + flat fee | 3% |

| Mobile Money Support | No | Yes | Yes | Yes |

| Local Availability | None | Full | Partial | Full |

Security features of each method

The security framework of each platform is unique. ExpressPay's PCI DSS certification ensures the highest level of transaction security. This standard effectively protects cardholders from potential data breaches.

Mobile money services offer robust protection through multiple security layers:

- Mandatory PIN/biometric verification

- real-time fraud monitoring

- end-to-end encryption;

The Bank of Ghana requires all payment providers to follow payment application data security standards. Users can also set their own transaction limits to protect their finances if someone compromises their accounts.

User reviews and ratings

My testing revealed notable differences in user satisfaction between the platforms. Wise stands out with a 4.7/5 rating from users who appreciate its clear fee structure. Among local processors, DPO ranks highest with 4.6 stars, while Slydepay and Paystack follow with 4.1 and 3.9 stars, respectively.

Users praise these platforms for their fast transactions, but often point to slow customer support response times. Mobile money's ease of access makes it a preferred choice over Apple Pay's deposit methods for everyday transactions in Ghana.

Our Verdict

Ghanaian users have to look elsewhere for their digital payment needs, because Apple Pay's frictionless payment experience isn't available in their country. My research found that there are a number of barriers preventing Apple's contactless payment system from working in Ghana. These range from weak infrastructure to merchants who won't accept it.

The good news is that there are practical workarounds. People who want Apple Pay functionality can use platforms like Towb and Wise. These services connect international payment systems to local financial networks and allow users to access Apple Pay through intermediary accounts, although additional steps are required.

These alternatives will continue to fill the gap until Apple officially brings its service to Ghana. Better yet, the world of digital payments in Ghana is changing faster than ever. It offers sophisticated options that sometimes work better than Apple Pay for local users.

Other Deposit Payment Options in Ghana